What’s This Book About?

I Will Teach You to Be Rich doesn’t focus on becoming the next Wolf of Wall Street or retiring early to lounge on a beach (but if that’s your goal, go for it). It’s a straightforward, action-oriented guide to organising your personal finances in an achievable way—even if you dislike budgets, find investing confusing, and think compound interest sounds like magic.

In Ramit Sethi’s own words,

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

This book is suited for:

- People in their 20s and 30s with consistent incomes

- Anyone struggling with saving, investing, or managing debt

- People who prefer to automate rather than analyse

🧠 Author Snapshot: Who Is Ramit Sethi?

Ramit Sethi is a Stanford graduate. He is an entrepreneur and the creator of the blog “IWillTeachYouToBeRich.com”. He is like a financially knowledgeable companion who offers straightforward advice without any criticism. He also hosts, “How to Get Rich on Netflix”, where he guides real people facing genuine financial challenges.

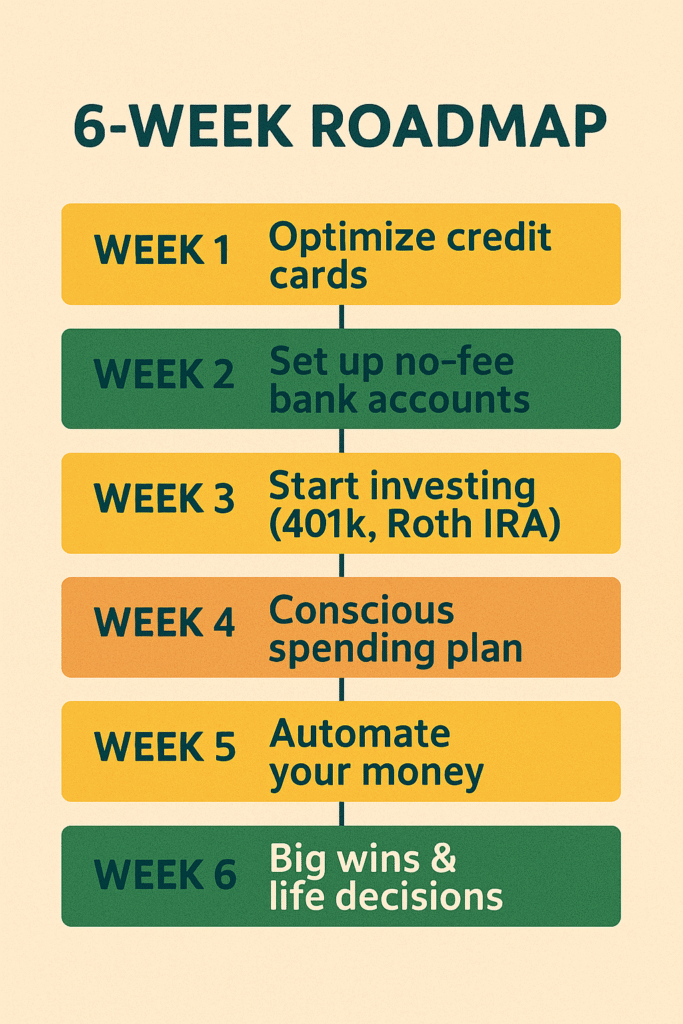

🧭 Overview of the 6-Week Program

Ramit doesn’t just throw out suggestions and say, “Good luck!” He structures the book into a six-week plan, with each week concentrating on a key aspect of personal finance.

Here’s what’s in store:

🔍 Chapter Analysis

Week 1: Master Credit Cards (Instead of Being Mastered)

Let’s be real: many of us received our first credit card without understanding what an APR meant. Sethi clarifies that and walks you through how to:

- Choose a no-fee rewards card (and steer clear of store cards)

- Set up automatic monthly full payments

- Utilise credit card benefits (such as travel points and fraud protection)

- Keep track of your credit score (using sites like Credit Karma)

- Negotiate late fees and interest rates like an expert

🧠 Pro Tip: Contact your card provider and say, “Hi, I’ve been a loyal customer for X years. I’d like to request a lower APR or have this fee waived.” You may be surprised by how often this is successful.

🎯 Objective: Achieve a credit score above 750, which will save you considerable amounts in interest later on.

Week 2: Outsmart the Banks

Banks should serve as trustworthy places for your money, not greedy entities draining it with $35 overdraft fees.

In this section, you’ll discover:

- Why most major banks are financial disasters

- How to transition to online banks that offer:

- No maintenance fees

- No minimum balance requirements

- High-yield interest rates

- Why keeping checking and savings accounts separate is crucial, like separating church and state

💰 Recommended Tools by Sethi:

• Capital One 360, Ally or Schwab for banking

• Simple automation solutions for bill payments and transfers.

🎯 Objective: Avoid fees, earn actual interest, and manage your cash flow effectively.

Week 3: Discussing Retirement (Before You Doze Off)

This is typically when people start to lose interest. However, Sethi presents it in a light-hearted way:

“You’re going to find wealth by being boring.”

You will discover:

- The differences among a 401(k), Roth IRA, and Traditional IRA

- How to take full advantage of employer contributions (which means free cash)

- The importance of starting early rather than trying to be perfect from the get-go

- The reason to overlook trendy stock recommendations and focus on more stable investments such as:

- Target-date funds

- Index funds (Vanguard, Fidelity, Schwab)

📊 Example:

• Contribute $500 per month beginning at age 25 → over $1 million by 60

• Begin at age 35? You’ll need to invest double that amount to achieve the same outcome

🎯 Objective: Establish automatic contributions to your 401(k) and open a Roth IRA. Then, forget about it and let compound growth work its magic.

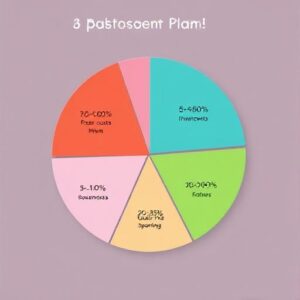

Week 4: Intentional Spending (Budgeting for Those Who Dread Budgets)

This is where it gets exciting. Ramit flips the conventional budgeting method upside down.

- Rather than counting every coffee purchase, he introduces a “conscious spending plan”

- You categorise your income as follows:

- 50–60%: Essential expenses (rent, bills, loans)

- 10%: Investments

- 5–10%: Savings targets

- 20–35%: Guilt-free indulgence (yes, that’s right)

💸 Fond of luxury shoes or iced coffee? Budget for it. Reduce your expenditure on items that aren’t important to you (I’m talking about those overlooked subscriptions).

🎯 Objective: Create a monthly budget that you can genuinely stick to without feeling discomfort.

Week 5: Automate Like a Pro

If you’re still manually transferring funds between accounts, stop. There’s a safer way.

Check out the “Money Flow System” Sethi endorses:

- Paycheck → Checking account

- Checking automatically allocates to:

o Roth IRA / 401(k)

o High-interest savings (for emergencies, goals)

o Fixed expenses (rent, utilities)

o Guilt-free spending fund

This system guarantees:

- You consistently save and invest first

- You never miss a bill payment

- You don’t mistakenly use your savings for late-night impulse purchases

🧠 Extra tip: Explore tools such as You Need a Budget or Mint for tracking your finances.

🎯 Objective: Minimise the time invested in financial management and enhance your enjoyment in life.

Week 6: Major Gains, Not Just Nickels and Dimes

Want to learn where most financial experts miss the mark? They suggest forgoing small pleasures like lattes. Ramit advises focusing on substantial gains instead:

- Negotiate a better salary

- Buy a vehicle wisely (avoid new cars and financing if possible)

- Plan a wedding that doesn’t leave you broke

- Understand the key questions to consider when buying a house.

He also discusses:

• Why renting isn’t merely wasting money

• How to have money discussions with your partner without causing conflict

💬 Memorable quote:

“Concentrate more on $30,000 choices and less on $3 choices.”

🎯 Objective: Target significant financial factors that truly drive progress.

🔑 Core Concepts Recap

| Concept | Meaning |

|---|---|

| Automation | Establish your finances on autopilot to ensure consistent saving/investing |

| Conscious Spending | Intentionally budget without feeling guilty |

| Rich Life | Your version of happiness—not someone else’s |

| Invest Early | Compound interest is your best ally—begin now, not later |

| Ignore Noise | You don’t need the “perfect” investment strategy. Consistency surpasses complexity. |

✨ Final Thoughts: Your Wealthy Life Begins Here

This book does not guarantee quick wealth or flashy promises involving cryptocurrency. Instead, it provides a genuine, sustainable approach to managing your finances—with humour, transparency, and no judgment.

Ramit encourages you to create your own definition of a “Wealthy Life”—whether that involves exploring the globe, purchasing a home for your parents, or simply eliminating the stress of monthly rent.

So here’s what you should do next:

Choose one action from this summary. It might involve arranging automatic payments for bills. It might be establishing a Roth IRA. Perhaps it’s time to terminate that gym membership you haven’t used since 2022. No matter what it is, take action today.

You don’t need to achieve perfection. You just need to begin.